Interesting Contents

WHY THE SAFETY POINT

We are leading international Insurance service provider to make your happy life .

An Experienced Team to Consult with

The average relevant experience of the team associated with thesafetypoint is more than 15 years. The founder “N N Mathur” has more than 36 years of total industry experience as an IT consultant and has worked on many Financial Planning and Management applications and have devised information systems for many clients. In personal capacity he has written algorithms for Equity Market Tools and have helped many clients reap the fruits of profits from share market trading.

Other team members have equally cherishing experience wealth creation through Equity, Mutual Funds and Insurance tools

The Team

The average relevant experience of the team associated with thesafetypoint is more than 15 years. The founder “N N Mathur” has more than 36 years of total industry experience as an IT consultant and has worked on many Financial Planning and Management applications and have devised information systems for many clients. In personal capacity he has written algorithms for Equity Market Tools and have helped many clients reap the fruits of profits from share market trading.

Other team members have equally cherishing experience wealth creation through Equity, Mutual Funds and Insurance tools

We Work For Your GAINS

We have franchise for Max Life Insurance which is one of the top most insurance company, operating in India and offer world's few best products which help investors grow their wealth in guaranteed way. This company has highest Claim ratio of 99.35%. It is ranked 18th amongst India's Best Companies to work for in 2021.

It has INR 90407 Cr worth of Assets under Management and INR 1,087,987 Cr as Sum Assured. We along with Max Life Insurance will work to create and enhance your wealth and you will notional gains from Tax Free returns in most of the investment plans.

We have a dedicated team of Experts which keeps track on the market moments and keep advising you time to time. Through our knowledge partner Tavaga, we offer:

- Customized Advisory

- Robo Advisory and

- Advisory related to the NRI Investments in India

Investment Advisory for NRIs

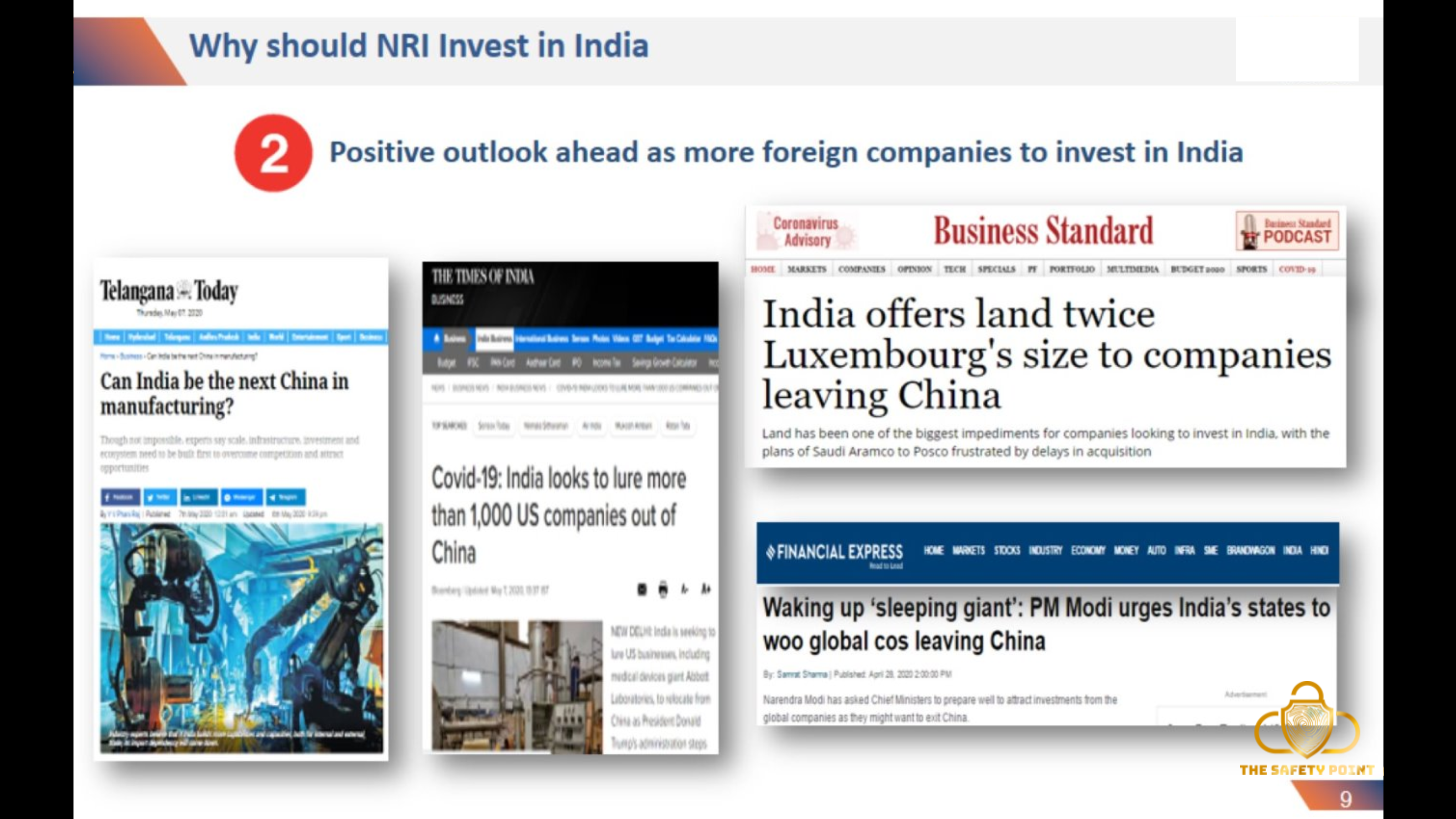

Why NRI should invest in India

India is well known for its information technology. Indian brains are helping growth in almost all countries in this world. India ranks second worldwide in farm output and 12th in the world in terms of nominal factory output.

- India's GDP is $3 Trillion and growing at a rate of 6.8%

- Indian Equity market has shown phenomenal growth and have sustained it for longer times

- The government of India has signed a Double Tax Avoidance Treaty with many countries which offers Tax Free Investment gains in Insurance investments and some identified Mutual Funds.

- The gains form investments in India surpasses gains in other countries by many folds, even after adjusting tax and currency rate fluctuation

Why NRI from USA should invest in IndiaWhy NRI from UAE should invest in India

Why NRI from Singapore should invest in India

QUESTION ANSWER

ASK US ANYTHING, WE’D LOVE TO ANSWER!

1. Who can Buy Insurance?

All individuals who fulfil the essential criteria of various insurance policies can buy them online. The online insurance buying or renewing process is quite easy and saves both time and money.

We offer Max Life Insurance plans. Explore the range of products we provide and live with peace of mind.

2. Is it safe to pay for insurance online?

All the customer-related details are kept safe in the online database maintained by the insurers, while the payments are accepted through secure payment gateways of the Life Insurance company.

3. How I can Buy an Insurance through you? How you can help?

Here are the necessary steps you can follow to buy insurance plans through us:

1. On this Website go to "What We Provide" section

2. Select relevant Insurance Plan which based on features you find appropriate for you

3. Fill in your details, as prompted by the online form and submit.

4. We shall Assist you either Online and if allowed through physical meeting and help you selecting most appropriate plan for you.

4. Can an insurance be cancelled?

If a policyholder feels that the purchased policy does not match his or her expectations, he is allowed to cancel it during the free-look period (15 Days from date of Issue) and get a refund. It is the period within which an insurance policy can be terminated without charging penalties on the buyer.

5. What is difference between Term insurance and whole life insurance? Which one should I buy?

Term insurance plans provide cover for a fixed period or 'term'. Generally companies offer coverage for 50 years (up to maximum age of 85 years). Term insurance plans are most affordable way of purchasing insurance and you can buy large a cover amount for a relatively small premium.

Whole life insurance policies cover you till the time of your death (up to a maximum age of 100, in most cases). In a sense, with a whole life plan, your family is assured of a payout in the event of your death. Given the high probability of death by such an advanced age, whole life insurance policies are significantly costlier than a term insurance plan.

Term life insurance is recommended in your earning years when your family is growing and your financial responsibilities outweigh your income. Whole life Insurance can be considered as an investment that will pass on to your family as a legacy. The key criteria for choosing an insurance policy should be the life cover requirement that stems from a financial planning exercise. Based on your life stage and investable income, you can make a choice

6. Will my premium amount increase with age?

No. The base premium amount remains constant during the entire duration of the policy and only the tax component can change and will be as per the prevalent Tax laws.

Hence it is advised to purchase term insurance at an early age. For example a ₹ 1 Crore cover at age 25 years will cost ₹7,670/year for a policy term of 40 years. At age 30, the same cover will cost ₹ 10,148/year which is 32% higher.

7. How much life cover should I buy in a Term plan?

The most common thumb-rule for selecting the cover amount (sum assured) is:

Sum assured = 10 X Annual income + outstanding loan amount

This is however a very broad rule and you should decide the cover amount after taking into account the number of your dependents, your income and liabilities and estimating the cost of sustaining the lifestyle for your family in your absence.

Max Life can provide you a cover of 22 X of your income depending upon your age and income. It is advisable to go for the maximum cover, since in a term plan you get high cover by paying a nominal premium

8. What is an e-insurance account (EIA)? Why is it mandatory?

An e-insurance account (EIA) allows you to hold all your insurance policies electronically under a single e-insurance account similar to how a demat account allows you to hold your stock and mutual fund investments.

There are 4 insurance repositories

1.NSDL Database Management Ltd,

2.Central Insurance Repository Ltd,

3.Karvy Insurance Repository Ltd and

4.CAMS Repository Services Ltd.

An e-insurance account can be opened directly with any one of them. All insurers are required by law to open an e-insurance account for the policyholders within 15 days of selling them an insurance policy online.

With an electronic form of your life insurance policy, there is no risk of losing the physical copy and it becomes easier for you or your nominees to track the details of your policies.

BEST SERVICES FOR YOU

What We Provide

We are leading international Insurance service provider to make your happy life .

Today’s financial Markets are very volatile and general investor needs a Qualified /Trained and experienced professional to assist them in achieving their short term and long-term Investment goals and create and protect their wealth.

Thesafetypoint is a project of Unilink Softwares Pvt. Ltd., A software development and consulting company delivering unique applications in Indian and international markets since 1994.

We at https://thesafetypoint.com through our able team comprising of well experienced profiles aims to assist clients with dedication and integrity so that we exceed their expectations and build enduring relationships. It is the diversity of the needs of our clients, which challenges us to strive to find the best solutions for each one of them.

Through our team’s experience we want to empowers our clients by giving them access to the same technology, processes, advice and investment products as those used by professional investment funds.

Company Information

Today’s financial Markets are very volatile and general investor needs a Qualified /Trained and experienced professional to assist them in achieving their short term and long-term Investment goals and create and protect their wealth.

Thesafetypoint is a project of Unilink Softwares Pvt. Ltd., A software development and consulting company delivering unique applications in Indian and international markets since 1994.

We at https://thesafetypoint.com through our able team comprising of well experienced profiles aims to assist clients with dedication and integrity so that we exceed their expectations and build enduring relationships. It is the diversity of the needs of our clients, which challenges us to strive to find the best solutions for each one of them.

Through our team’s experience we want to empowers our clients by giving them access to the same technology, processes, advice and investment products as those used by professional investment funds.